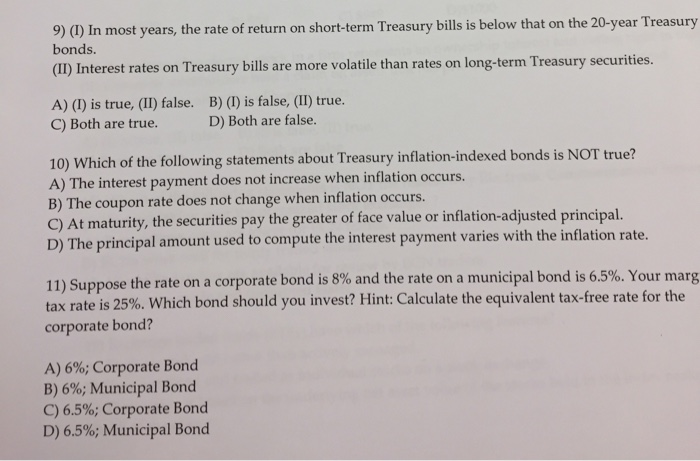

Which of the Following Statements Is False Regarding Municipal Bonds

O Interest income from municipal bonds is taxable on the taxpayers federal return. O Municipal bond interest may be taxable in the state in which the bond was issued.

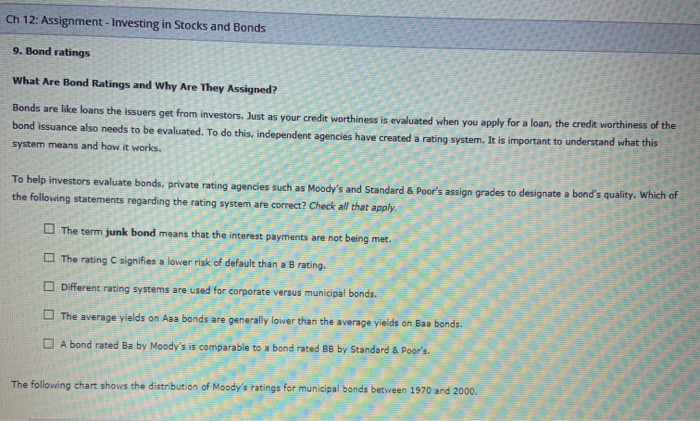

Solved 9 1 In Most Years The Rate Of Return On Chegg Com

Option B is incorrect.

. Which of the following statements is are false regarding municipal bonds. The municipal bond is commonly called as the Muni Bond is the bond which is issued by the local government or the territory. III The interest income from a municipal bond is exempt from federal income taxation.

Instead general obligation are backed by the full faith and credit of the issuer which has. III The interest income from a municipal bond is exempt from federal income taxation. IV The interest income from a municipal bond is exempt from state and local.

I A municipal bond is a debt obligation issued by state or local governments. IV- The interest income from a municipal bond is exempt from state and local. II A municipal bond is a risk free security issued by US Treasury.

O Interest from a municipal bond will be reported on Form 1099-INT box 8. I- Municipal bond is a debt obligation issued by the federal government II- Municipal bond is a debt obligation issued by state and local governments III- The interest income from a municipal bond is exempt from federal taxation. I A municipal bond is a debt obligation issued by state or local governments.

The municipal bond is used to finance the public projects generally. The interest income which is received by municipal bonds holders is excludable often from the gross income for the. Which of the following statements is FALSE regarding municipal bonds.

The two most common types of municipal bonds are the following. I A municipal bond is a debt obligation issued by state or local governments. General obligation bonds are issued by states cities or counties and not secured by any assets.

IV The interest income from a municipal bond is exempt from state and local taxation in the issuing state. Which of the following statements is FALSE regarding municipal bonds. Interest income from municipal bonds is taxable on the taxpayers federal return.

Hence Option A is correct. Asked Jan 7 2019 in Business by Melissa2021. III The interest income from a New York municipal bond is exempt from federal income taxation as well as state taxes for a tax payer filing taxes in.

Which of the following statements are correct regarding municipal bonds. II A municipal bond is a debt obligation issued by the federal government. Interest from a municipal bond will be reported on Form 1099-INT box 8.

II A municipal bond is a debt obligation issued by the federal government.

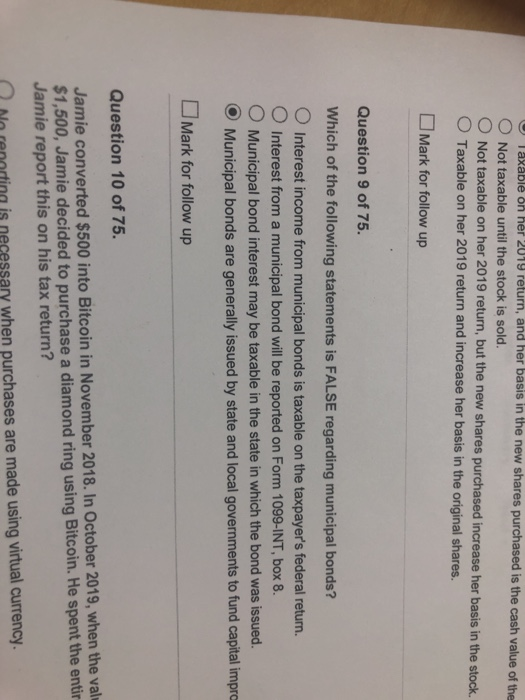

Solved U Taxable On Her 2014 Return And Her Basis In The Chegg Com

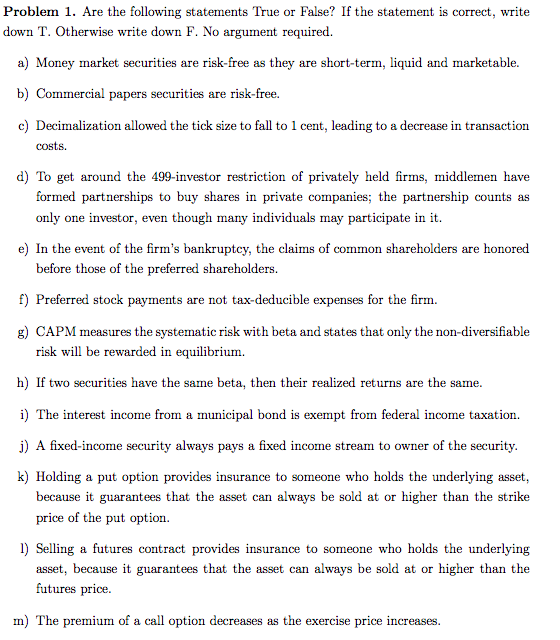

Solved Problem 1 Are The Following Statements True Or Chegg Com

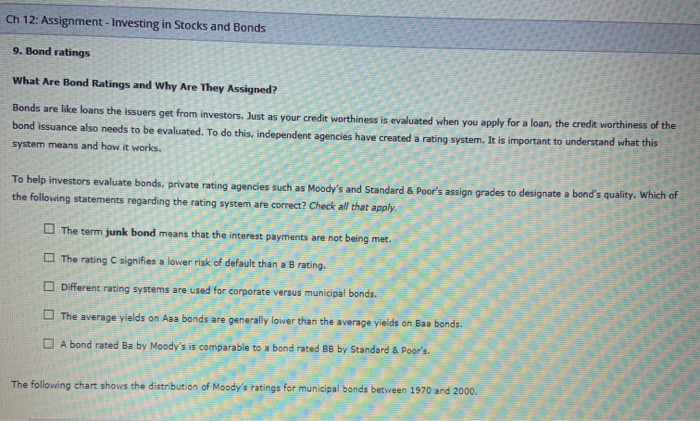

Solved Ch 12 Assignment Investing In Stocks And Bonds 9 Chegg Com

Comments

Post a Comment